Mortgage Recovery 4-Course Series: From Insights to Implementation

The Mortgage Recovery 4-Course Series is a structured, quarter-long program designed for mortgage servicers, lenders, and creditors to leverage data for improved borrower outcomes, reduced delinquency, and stronger portfolio performance. Participants gain hands-on experience using community and borrower data to identify high-risk areas, design actionable programs, and pilot solutions with measurable impact.

Included Courses & Objectives:

Data Insights: Analyze borrower and market data to uncover opportunities and risks.

Strategic Leadership & Design: Translate insights into actionable strategies and program designs aligned with organizational and regulatory goals.

Action Planning & Readiness: Develop operational plans, assign roles, and assess organizational readiness for execution.

Pilot Implementation: Launch and refine small-scale pilot programs with expert coaching to ensure scalability and measurable results.

Course Delivery Format:

Course 1 through 3: Virtual Live

Course 4 - Pilot Implementation: Hybrid (Virtual Live and In-Person)

Who Should Attend:

Mortgage servicers, lenders, and creditors seeking a structured, data-driven approach to improve recovery, mitigate risk, and expand lending effectiveness.

Program Structure & Schedule:

Four sequential courses over a 12-week quarter.

Courses offered in multiple time slots to accommodate organizational schedules.

Pilot Implementation runs for four weeks with ongoing coaching and practical exercises.

Value to Your Organization:

Reduce Delinquency & Risk: Identify at-risk borrowers early and tailor interventions.

Data-Driven Decisions: Apply actionable insights to strategic and operational plans.

Scalable Programs: Pilot solutions locally and scale across your portfolio with confidence.

Regulatory Readiness: Strengthen compliance and reporting for fair lending and CRA requirements.

Materials:

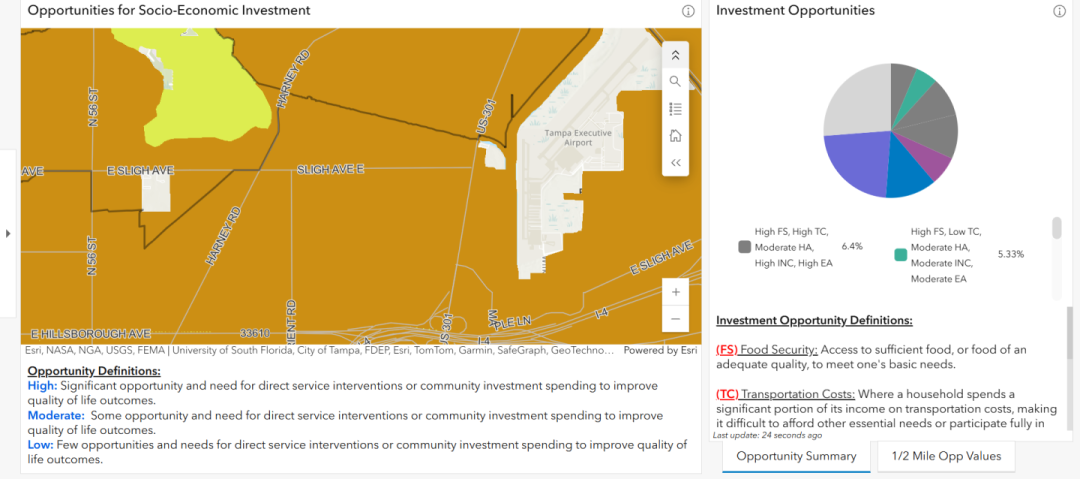

During the workshop, participants receive access to data for a random geography provided by Pivot.

Participants receive a free 3-day trial to the Pivot to Opportunity Dashboard upon workshop completion.

Pivot cannot guarantee that the data provided during your 3-day trial will be specific to the region you work in.

Certification:

Participants completing all four courses are eligible for Pivot Certification, recognizing applied mastery of data-driven mortgage recovery strategies.

Certification fees begin at an additional $350 per participant, after completing all four courses.

Single-course attendees can accrue credits toward certification if they later complete the full series.

Sign Me Up!

Contact us at 520-405-2029 or info@pivotpartnerships.org to register for Small Group, Team, and Enterprise discounts.

Data Review Disclaimer

By providing data for review, the client acknowledges that all datasets must be clean, accurate, and in a usable format prior to submission. Pivot Partnerships does not assume responsibility for performing extensive data cleanup, though minor formatting adjustments may be made as needed to complete the purchased service.

Any data files submitted to Pivot Partnerships for review will be used solely for the purpose of delivering the purchased service. Pivot Partnerships will not return modified or cleaned datasets to the client. Unless the client provides written instructions to the contrary, Pivot Partnerships will securely delete all submitted data upon completion of the engagement.

Refund & Cancellation Policy

Certifications

No refunds are available for certification fees (individual or organizational).

Courses (Individual Registrations)

Refunds:

100% refund (minus 25% cancellation fee) if canceled 14 or more days before the course start date.

No refunds within 14 days of the course start date.

Credits:

Cancellations made 5 or more days before the course start date are eligible for a credit toward a future course of equivalent value.

Credits are valid for 6 months, are non-transferable outside the original registrant’s organization, and must be redeemed using the original receipt number.

Credits respect the original purchase value, including any discounts applied.

No-shows without prior cancellation are not eligible for refunds or credits.

Full Course Series Purchases

Refunds are not available for bundled or series purchases.

Registrants may receive a credit toward future courses equal to the original purchase value, subject to the same rules above.

Multi-Seat Purchases (Organizations/Groups)

Refunds are not available for multi-seat purchases.

Organizations may receive a credit toward future courses equal to the original purchase value, subject to the same rules above.

Fairness Statement

This policy ensures fairness to all participants and allows us to maintain the quality and consistency of our programs.